Private Equity

Creating growth

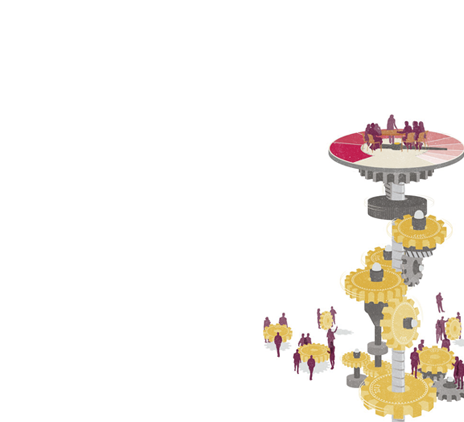

Private equity has always focused on creating value and helping promote growth in portfolio companies. Since the industry began, private equity firms have tried many ways to meet this ultimate objective – and with varying success. Now, post the global financial crisis, the question being asked more than ever is: how can private equity deliver its value-added promises?