Armenian Audit Market: Top Seven in Focus

Armenia’s Audit Market 2025 – Key Findings from Grant Thornton’s Latest Study

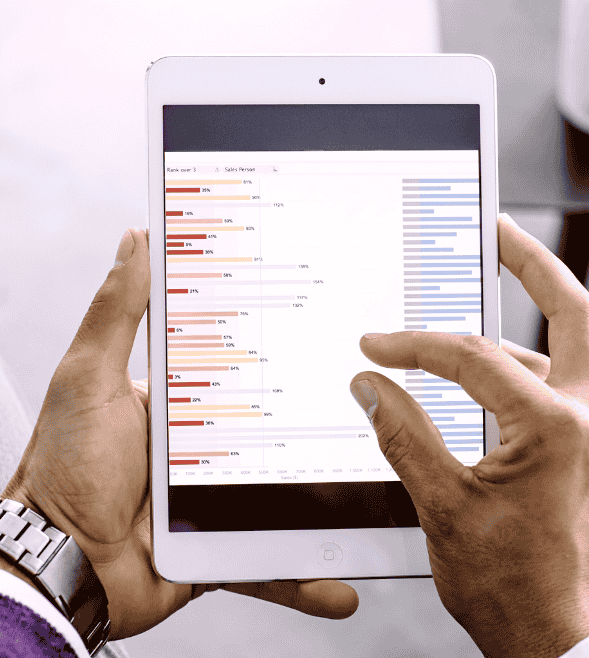

Grant Thornton Armenia’s Audit Market Study 2025 – Top Seven in Focus provides a concise overview of Armenia’s audit sector, examining revenue performance and client dynamics among the leading firms.